How AI is changing Finance: TOP-5 Cutting-Edge Applications and Their Advantages & Disadvantages

Artificial Intelligence (AI) is revolutionizing the way we live and work, and the finance industry is no exception. From fraud detection to portfolio management, AI is transforming the way we manage our finances. In this article, we'll explore the top 5 AI-powered finance apps that are changing the game.

These apps use machine learning algorithms to analyze large amounts of data and provide personalized financial advice to users. But with all the benefits, there are also some concerns about privacy and security. We'll look at the pros and cons of using these apps and what you need to know before downloading them.

The future of AI in finance is bright, and it's important to stay informed about the latest developments. Whether you're a financial professional or just someone interested in managing your finances more efficiently, this article will provide you with valuable insights into the world of AI-powered finance apps. So, let's dive in and explore the exciting world of AI in finance!

Introduction To AI In Finance

The intersection of AI and finance is rapidly evolving and has become essential for financial organizations. AI offers the potential to transform the financial industry by allowing companies to make better predictions, personalized recommendations, automate tasks, detect fraud, and deliver frictionless customer interactions.

AI can help financial institutions mitigate risk by analyzing vast amounts of data in a short amount of time. This technology enables financial technicians to identify patterns that were previously impossible for humans to detect without automation. For instance, automated trading algorithms use AI models to forecast stock prices with remarkable accuracy while chatbots use natural language processing (NLP) technology to provide robust customer service.

Moreover, AI reduces costs by reducing manual labor and providing real-time insights into financial data. In the future, it will eliminate many currently redundant jobs developed specifically for low-grade transactional work: such routine chores as verification requests or simple client inquiries could be fully handled via machine learning-based systems consisting of virtual assistants - freeing up human resources for more nuanced jobs.

Overall, it is clear that AI has emerged as a critical component in meeting the infrastructure needs of today's digital economy in finance. The adoption curve whereby time-cost expenses are offset by longer-term advantages continues to play itself out as more and more investors look towards these algorithmic advancements for an edge on their transactions amidst other modernizing tech trends like blockchain or cloud Computing.

The Top 5 AI-powered Finance Apps

To keep up with the fast-advancing finance industry, companies are integrating AI to improve efficiency and customer experience. Here are the top 5 AI-powered finance apps.

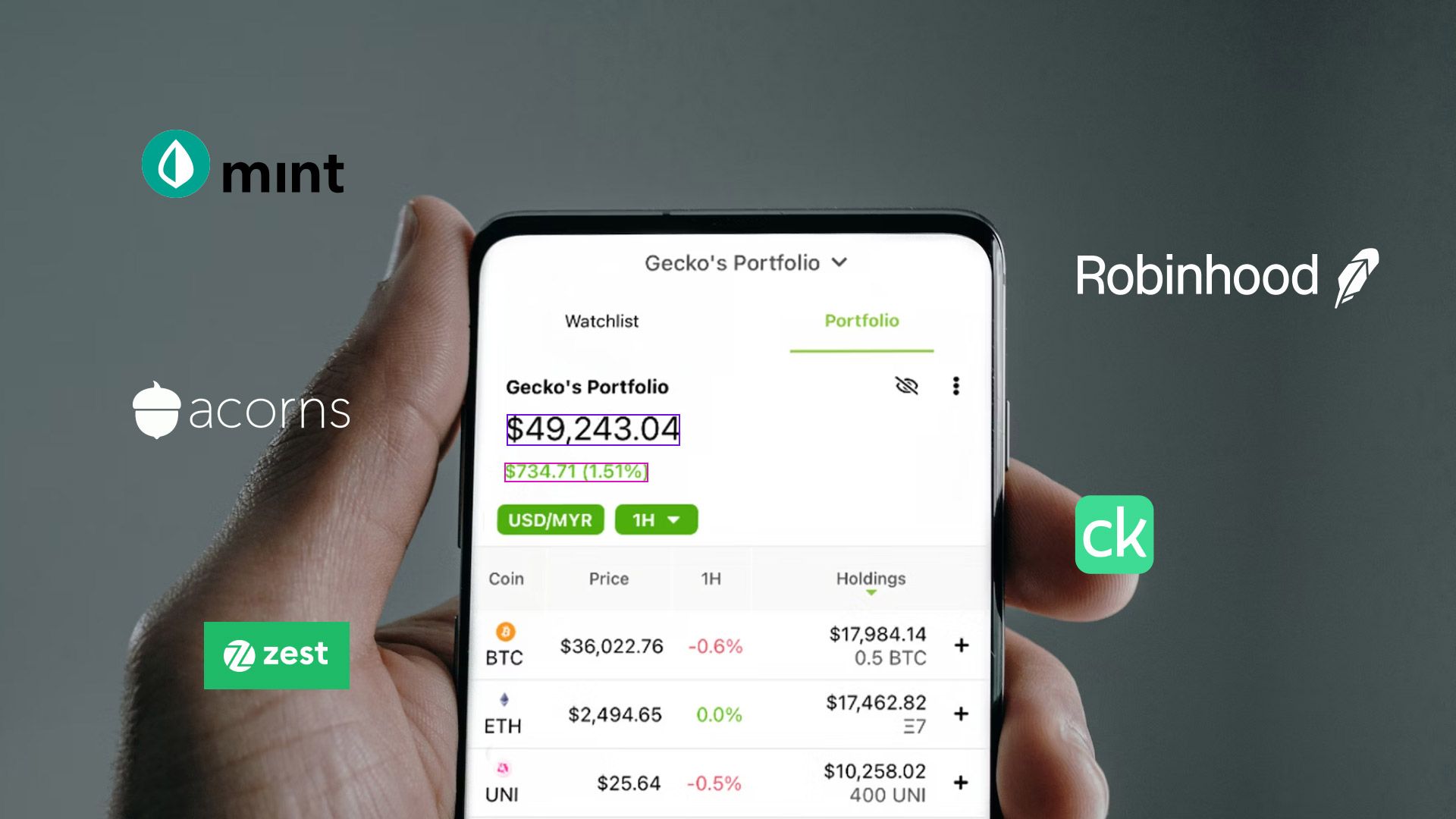

1. Mint: This app helps users manage their finances by linking bank accounts, credit cards, and other financial accounts in one place. It automatically categorizes transactions and gives personalized insights into spending habits. However, users might be concerned about data privacy as it requires access to personal financial information.

2. Robinhood: This trading app uses AI algorithms to suggest investments that match user portfolios and preferences. It also alerts users of stock movements in real-time, making it a useful tool for those interested in investing in the stock market. The downside is the lack of complete control over trades as Robinhood executes trades without user consent at times.

3. Credit Karma: Using AI technology alongside real-time analytics data from credit bureaus like Equifax and TransUnion, Credit Karma offers personalized tips to improve credit scores while identifying loans or credit cards that fit specific criteria for each user's profile without impact on their overall score —further expanding its services beyond just 'credit scoring.'

4. Acorns: This investment app rounds off purchases made via linked debit/credit cards; then captures the "spare change" for micro-investing in exchange-traded funds (ETFs) automatically managed and monitored by robo advisors —offering smart one-click ETF portfolios driven by machine learning algorithms based on consumer behavior models rather than actual market research.

5. ZestFinance: By replacing traditional indicators like FICO scores with a modern ML-based approach evaluating first-party client-specific behavioral data-points; this platform seeks to bridge gaps in lending outputting accurate risk assessments & developing smart predictive models powered by deep psychometric profiling ensuring not only accurate underwriting but speedily driving lenders towards an objective reality avoiding default risks wherever possible.

AI-powered finance applications have maximized automation making these apps a must-have for savvy investors. They create access to instant information, money management insights, assist in predicting stock market trends and offer flexibility while ensuring customers' privacy.

Cons And Pros Of Using These Apps

Financial organizations worldwide are using artificial intelligence (AI) to automate mundane tasks, enhance customer experience, and analyze data from various sources to improve risk management. AI can also work faster than manual processes, and provide better insight into financial data.

However, programmed bias in machine learning algorithms can be a major risk in AI applications in finance. Biased results could lead to false conclusions and incorrect decisions that could potentially affect the well-being of customers and overall financial stability.

Another potential problem is that many organizations cannot afford premium AI applications. As a result, they may end up with poorly trained models or completely ineffective solutions that ultimately cost more than they save.

Furthermore, while AI-enabled machines can take care of routine tasks, including monitoring accounts for unusual behavior patterns or flagging potential fraud cases quickly, it may displace human employees who previously carried out those tasks manually.

Despite the considerable benefits of these apps for personal finance trends tracking already on the market offering unprecedented insights into consumer habits and spending behaviors comes at a relatively high price point that some people may find unaffordable.

The Future Of AI In Finance

The future of AI in finance is bright. AI has already proven to be an asset in the industry, helping financial institutions evaluate historically underserved borrowers and reducing the risk of fraudulent transactions. Additionally, AI boosts efficiency and leads to higher profitability and customer satisfaction.

As the usage of AI in finance continues to grow, countries like China and the US are investing more heavily into research and development. Robo-advisors such as Betterment offer automated investment management services, giving customers a low-cost alternative to traditional financial advisors.

While there are certainly benefits to using AI in finance, it is important to acknowledge its limitations. For example, AI lacks emotion and creativity when making decisions. It can also be expensive for financial institutions to implement.

Despite these limitations, it seems likely that the future of finance will continue moving toward increased usage of AI. As data scientists continue their work designing programs that can better analyze data patterns and improve decision-making capabilities over time with machine learning algorithms that learn from feedback loops on accuracy factors - we'll see more innovation coming from FinTech startups.