Computer Vision Applications for Retail Banking

Commercial banks have long been leaders in the implementation of AI, with early adoption of machine learning practices helping them to refine trading strategies and assess risk. Now retail banking is one of the industries at the forefront of incorporating computer vision based AI models into their businesses.

However, viability of AI powered, customer facing systems relies on diverse, scalable, and accurate image and video training data. By leveraging the expertise of annotation providers, like Keymakr, and accessing quality training data developers can transform customer interactions and the efficiency of banking operations.

This blog will analyse four areas of innovation in retail banking AI and pinpoint the annotation techniques and services that can ensure the continued success of this exciting technology.

Spotting counterfeit documents and currency

Counterfeit currency remains a significant problem that costs businesses and undermines public confidence. In 2019 an estimated 33,732 fake Canadian bank notes made their way into circulation. Forged identity and other official documents can also interfere with bank operations.

This can lead to loans being given out in error and can indicate money laundering for criminal purposes. Thankfully, AI is providing solutions for the damaging counterfeiting of currency and documents. Computer vision systems can be trained to identify subtle differences between real and fake materials when they are used or deposited at a bank.

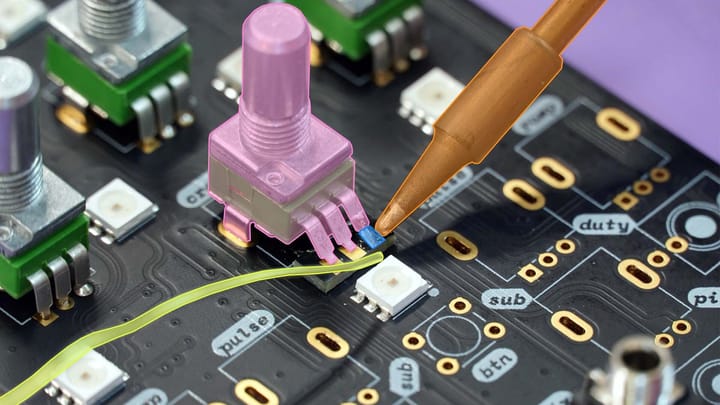

Accurate labeling is an essential component of this research. Annotation providers make use of experienced teams to precisely label counterfeit and genuine training images in line with developers needs.

Speeding up manual processes with document recognition

Despite the move to online banking more complex retail banking transactions still require physical documentation to be assessed and verified. The checking and distribution of mail documents received by branches is a time consuming and labour intensive task.

Document recognition AI is able to quickly sort through incoming materials and then route them to the appropriate member of staff. Simple transactions, such as processing cheques, can also be digitized using this technology. Document annotation powers these innovations by allowing models to distinguish defining characteristics or relevant sections of diverse banking documents.

Biometrics for identification

Biometrics allow for the secure and consistent identification and authentication of individuals. Facial recognition software incorporates machine learning algorithms to locate key identifying features on faces. In the banking context this allows AI systems to match an individual with other existing photo documentation, such as passports and driving licenses.

This means that it is now possible to open up a bank account or take out a loan remotely, using a smartphone. Landmark point identification provides the key training data for biometric AI applications. By learning from annotated images with the positions of noses, mouths, and eyes precisely located, AI models can consistently match customers with their identifying documents.

Analysing contacts with document annotation

Machine learning is allowing banks to analyse huge quantities of documents, saving both time and money. Common documents, such as commercial credit agreements, can be assessed by algorithms, and the most relevant details can then be taken from them.

This process would ordinarily require a significant investment in terms of resources and work hours. Training data can help AI models with specific document types. Certain, non standard documents, such as invoices, can be labeled with important contextual information, supporting the development of useful systems.

Image and video annotation services for retail banking

The move away from in person banking is creating space for a variety of computer vision based AI innovations. By outsourcing to professional annotation services industry leaders can ensure a smooth flow of accurate training data. Keymakr achieves this through the use of proprietary technology, and teams of skilled annotators overseen by experienced managers.